Natural cosmetics Report

Spain’s position in the natural cosmetics market

Spanish natural cosmetics are increasingly entering the international market thanks to the Espacio España Beauty From Spain, created by ICEX at the German trade fair Vivaness. It is an event on ecological cosmetics that is held every February for three days in Nuremberg.

The products that stand out in the Spanish exhibitors are a pediatric line, natural dyes without ammonia, intimate feminine hygiene treatments, a 100% organic sunscreen and handmade soaps. In addition to skin and hair products based on aloe vera, snail slime and tea tree.

Products on display at Vivaness 2020. Source: Vivaness

Following Trademap data, in 2019 Spain ranked among the top 20 countries exporting beauty products with an annual growth of 16% since 2015. Our first client would be Portugal followed by France. Germany, a major supplier of these products worldwide, ranks sixth among our importers.

The German natural cosmetics market

Germany and France are the most established natural cosmetics markets in Europe. Consumer concerns about sustainability and the pursuit of an environmentally friendly world have triggered the growth of this sector compared to others.

The German market is constantly evolving. In 2017, France was its main supplier, followed by Poland and Switzerland. In that year, Spain ranked tenth.

The main German Naturkosmetik brands include Santé, Dr. Hauschka, Logocos Group and Lavera, among others. To gain a foothold in the German market, most of these brands have had to invest heavily in subsidiaries, sales offices, their own salesmen or distributors.

Spanish products are not well established in Germany. Among the few Spanish brands that stand out in this market, we find Puig. A Catalan company with 26 subsidiaries and regional offices in 25 countries whose products are distributed in more than 150 countries.

The Spanish products that most attract the attention of German customers are those containing olive oil and aloe vera. Other important Spanish natural cosmetics companies are Ibizaloe and Aloe Plus Lanzarote. However, we must not forget that the natural cosmetics market is a market that has already been hardened by the big companies, its clientele is very demanding, preferring to buy products with certifications that provide them with security and confidence, and there is increasing competition with the private labels.

Certifications in Germany

For Germany and its inhabitants, certifications for natural cosmetic products are of vital importance. Among the most renowned certifiers are:

- COSMOS (COSMetic Organic and natural Standard)

- ECOCERT

- BDIH (International Organic and Natural Cosmetics Corporation)

- COSMEBIO

- NATRUE

- INSPECTA (the preferred certification for Spanish companies)

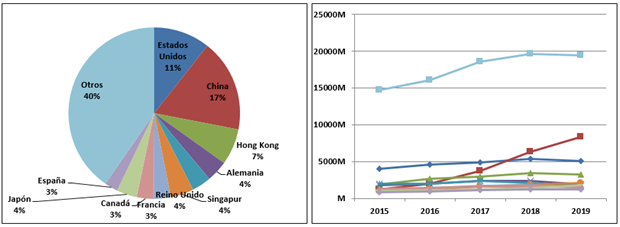

Graph of main importing countries worldwide

Source: own elaboration based on data from https://trade.nosis.com/es

The graphs show that China is the country that receives the most imports of cosmetic products, followed by the United States.

The Chinese market for foreign cosmetics is experiencing a boom. Thus, China went from being the eighth largest importer of cosmetics in 2014 to the largest importer of cosmetics in 2019.

One of the reasons for this trend in China for cosmetics is the development of e-commerce and online payment. In this way, many SMEs have been able to sell their products in China, saving administrative procedures.

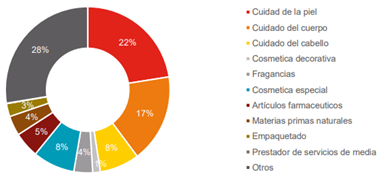

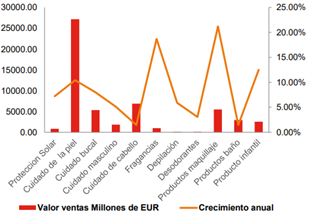

In this graph we can see the sales of cosmetics by category and the growth in the period 2017 – 2018. The products that undoubtedly interest the Chinese population are cosmetics dedicated to skin care.

Source: https://www.icex.es/

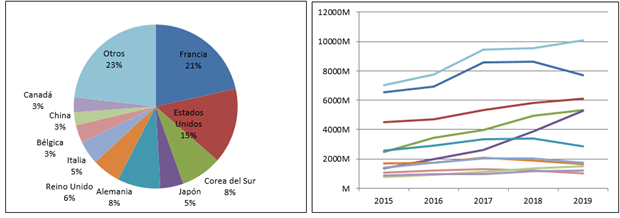

Graph of main exporting countries worldwide

Source: own elaboration with data from https://trade.nosis.com/es

Among the main cosmetics suppliers are our neighboring country France, followed by the United States, South Korea, and Japan.

As we have already seen, cosmetics products are highly valued in China. France is the world’s leading exporter and China’s main supplier in this sector. Both globally and in terms of China’s suppliers, exports from Asian countries such as South Korea and Japan are increasingly gaining strength. In 2019, the growth of exports made these countries a strong competitor to the United States and France.

Sources

- https://aloepluslanzarote.com/

- https://ibizaloe.com/

- https://www.cosmos-standard.org/

- https://www.ecocert.com/

- https://www.icex.es/

- https://www.natrue.org/

- https://www.naturkosmetik-konzepte.de/

- https://www.puig.com/es

- https://www.vivaness.de/en

- María del Mar Santacana Boronat. Vivaness 2020 trade fair report. Düsseldorf. 31 March 2020. NIPO 114-20-024-0. 28 Pg. Available in: https://www.icex.es/